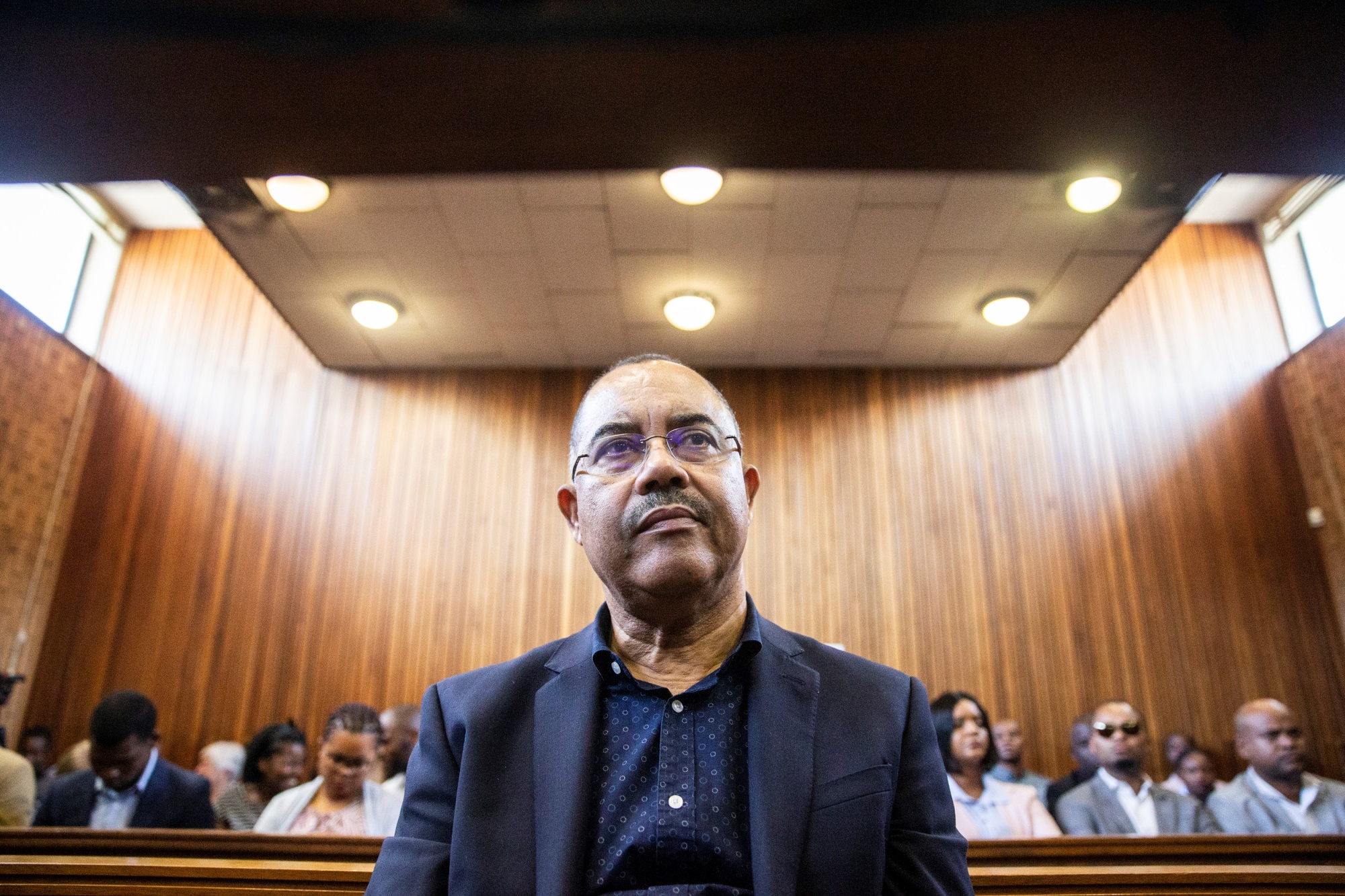

A former Mozambique finance minister was found guilty on Thursday of conspiracy to commit wire fraud and money laundering in connection with a massive $2 billion loan scheme.

Manuel Chang was convicted by a federal jury in Brooklyn after a three-week trial.

Prosecutors alleged that Chang received $7 million in bribes from shipbuilding firm Privinvest in exchange for approving government guarantees for loans to three state-owned companies.

These loans, secured from Credit Suisse and VTB Bank, were ostensibly for developing Mozambique’s fishing industry and improving maritime security.

The scheme, dubbed the “tuna bonds” scandal, ultimately collapsed, leaving Mozambique in financial ruin.

The African nation defaulted on the loans, leading to a currency crash and the suspension of aid from international organizations like the International Monetary Fund.

Investors also suffered significant losses.

According to prosecutors, Chang funneled the bribe money through a Swiss bank account controlled by a friend.

He allegedly involved other government officials in the scheme to conceal his involvement.

The defense argued that Chang acted under orders from the Mozambican president and that the $7 million was not intended for him personally.

However, the jury ultimately sided with the prosecution.

Two former Credit Suisse bankers have already pleaded guilty in connection with the case and testified against Chang.

A previous trial involving another defendant, Privinvest salesman Jean Boustani, ended in acquittal.

The conviction marks a significant victory for the U.S. government in its efforts to combat corruption and hold accountable those involved in financial crimes with global implications.

Mozambique, one of the world’s poorest countries, has been grappling with the aftermath of the scandal.

The full extent of the fraud and the number of individuals involved remains under investigation.