Kenya’s finance ministry said on Thursday that it had signed an agreement with an insurance company owned by the Japanese government to issue a yen-denominated Samurai bond worth $500 million.

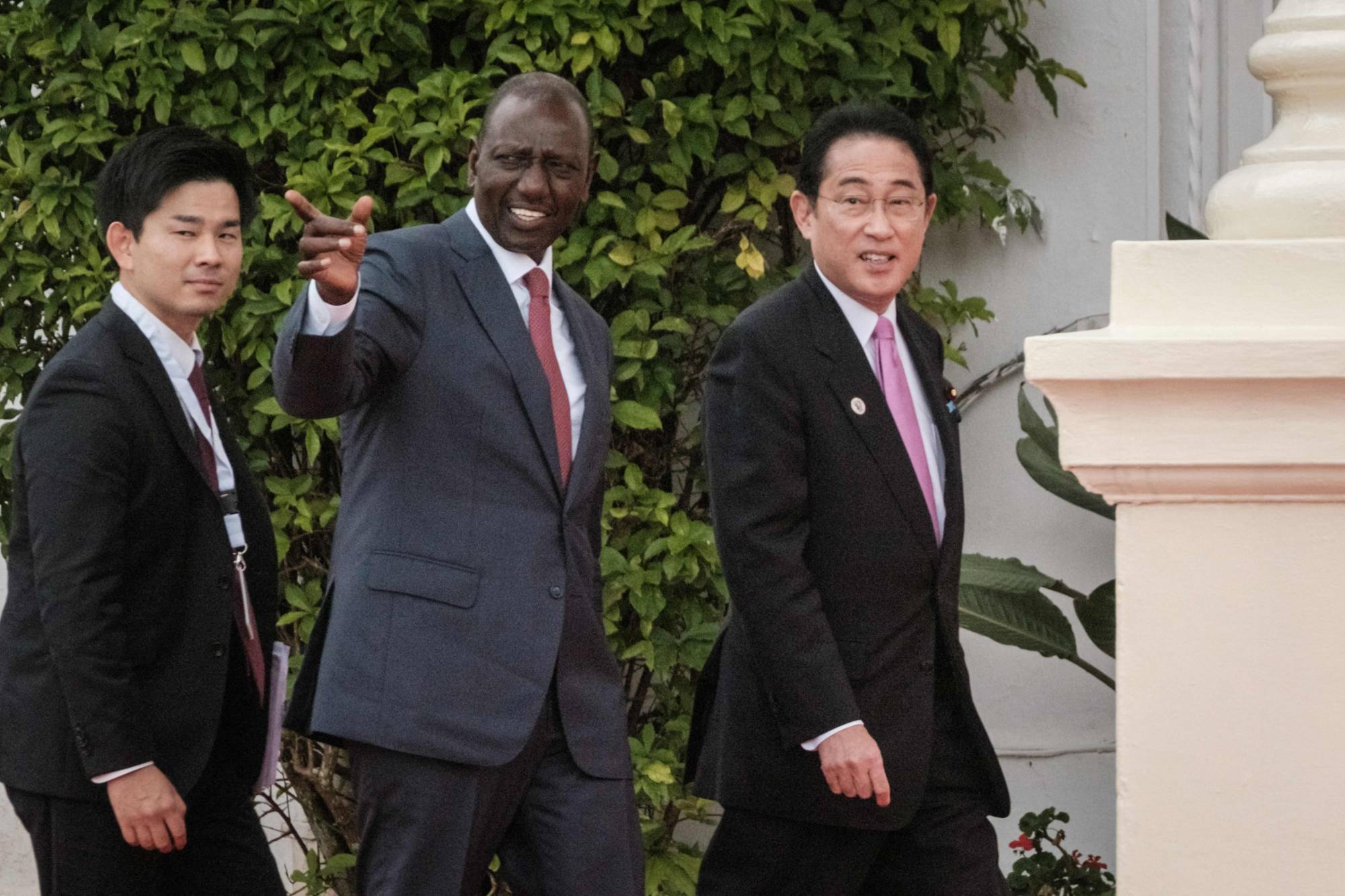

The agreement with Japan’s Nippon Export and Investment Insurance was announced during a visit by Kenyan President William Ruto to Japan.

A Samurai bond is a yen-denominated bond issued in Japan by a non-Japanese entity and subject to Japanese regulations.

The East African country has been on the radar of investors as its finances have been under strain ahead of a $2 billion international bond maturing in June.

But the government has recently secured financing from international lenders including the International Monetary Fund which has eased the pressure.

On Wednesday the government made an offer to investors in its $2 billion bond to exchange their holdings for a new U.S. dollar-denominated bond.

The finance ministry said in a post on X on Thursday that the sale of the Samurai bond would come in two phases of $250 million each and would be used to promote electric vehicles and enhance energy efficiency in Kenya’s transmission network among other things.

The bond issue is expected by June and the proceeds would be used in the fiscal year that starts in July, it added.